December 2025 Aluminum Price

In December 2025, aluminum prices in both the international and domestic markets experienced material fluctuations with a clear upside bias toward month-end, reflecting a shift in market expectations rather than a simple price rebound.

Prices moved from a mid-month low of 2,833.5 USD/mt to a month-end high of 2,945 USD/mt, representing a rebound of approximately +3.9% within two weeks. Compared with early-December levels, prices ended the month around +3.0% higher, signaling a meaningful upward adjustment in market valuation.

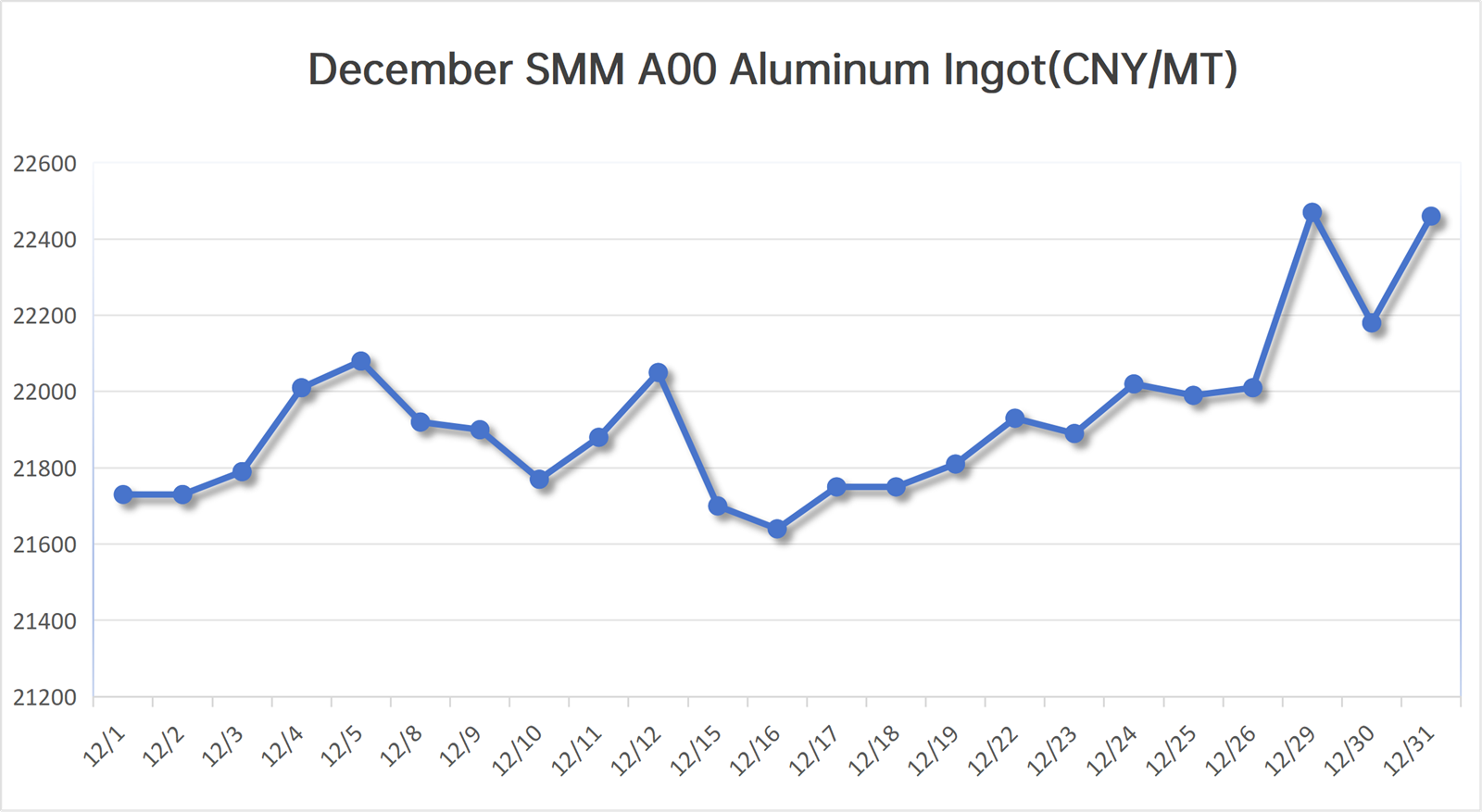

Domestic prices fell to a mid-month low of 21,640 RMB/mt before rebounding to 22,470 RMB/mt, marking a gain of roughly +3.8%. Although prices remained volatile, the magnitude of the rebound indicates stronger pricing power returning to the market.

Key Drivers Behind the Price Movement

Several factors jointly contributed to December's aluminum price re-rating:

Improved Macro Sentiment

Expectations around global interest rate stabilization and year-end macro adjustments supported risk appetite, providing a tailwind to base metals as a whole.

Supply-Side Discipline

Aluminum supply remained constrained, with limited short-term capacity expansion and ongoing cost pressures. This reduced downside risk and amplified price reactions once sentiment turned positive.

Inventory and Seasonal Effects

Spot availability tightened toward year-end, while downstream users engaged in selective restocking ahead of the new year, reinforcing price momentum in late December.

Market Psychology Shift

The decisive break above key technical levels late in the month triggered follow-on buying, accelerating the rebound and reinforcing bullish expectations for the near term.

Implications for Aluminum Coil and Pre-painted Aluminum Users

- The market is no longer in a purely defensive or declining phase.

- Price corrections are becoming shorter and shallower, while upward moves are more decisive.

- Waiting for deep price pullbacks may carry increasing risk, as downside space appears limited under current fundamentals.

- Cost uncertainty is likely to increase in the short term, particularly if macro sentiment continues to improve or inventories remain tight.

- Adopt a phased purchasing strategy, securing baseline volumes while retaining flexibility for incremental buys.

- Avoid aggressive "all-at-once" stocking, but also refrain from excessive delay that could expose buyers to rising replacement costs.

- For contract-based or export-oriented users, locking in part of future demand may help smooth cost volatility.

Looking ahead, aluminum prices are expected to remain volatile but firm, with near-term movements increasingly driven by sentiment, inventory dynamics, and macro signals rather than pure cost factors alone. For downstream users, the focus should shift from timing absolute price lows to managing price risk and procurement rhythm in a changing market environment.